For most taxpayers, tax season is already stressful enough as it is. You have to worry about outstanding debt, collecting all of your tax documents, making time to meet with an accountant in your busy schedule, etc. These concerns and stressors were only amplified by the arrival of COVID-19, which tightened budgets for Salt Lake City residents and across the nation.

Now, many are left wondering, “How does the coronavirus affect my tax debt?” If debt payments were difficult before, they’ve become ten times more challenging with so many people losing a source of income. The good news among all of this? The IRS is suspending collections, with certain exceptions, until July 15, which is also the last day to file your tax return. During this time period, no accounts will default, nor will any agreements be terminated. This is a temporary cushion to help taxpayers get back on their feet if they have been affected by the COVID-19 situation.

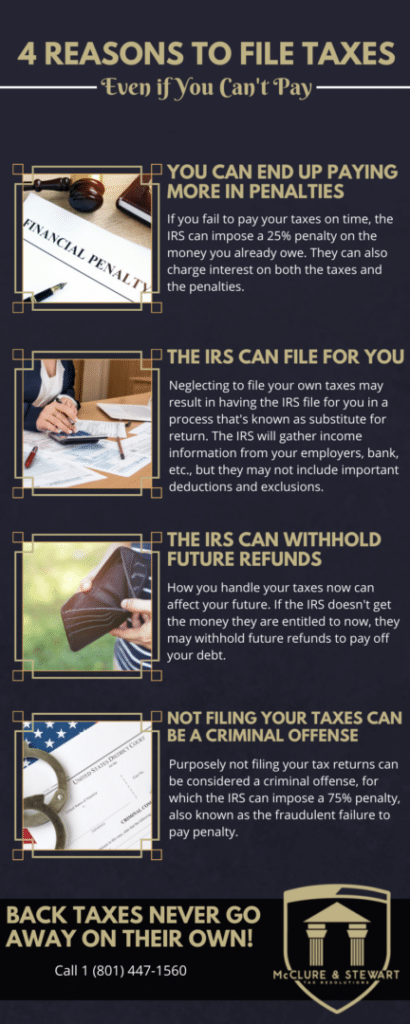

So, if you know that you can’t pay your tax debt, especially with money being tighter than usual, should you just skip the tax return this year? No! Take our word for it and file your tax return anyway. As leading tax relief attorneys in Salt Lake City and the surrounding areas, we know for a fact that starting out early is the best way to get ahead on back taxes. Plus, you can take advantage of the relief options the IRS is offering right now.

Relief Options

Installment Agreements

If you can’t pay your tax obligations at the moment, you may qualify for an installment agreement. This is like a payment plan where you pay off your debt little by little.

Those with existing installment agreements don’t have to make payments between April 1 and July 15 if they are financially struggling due to COVID. The IRS will not default any suspended accounts during this time, but you can still expect interest to accrue.

Private Debt Collection

Due to the financial crisis facing many households this year, the IRS will not collect outstanding debt through private agencies for the time being.

Offers in Compromise

Another option for those who are burdened with high outstanding debt is to apply for an Offer in Compromise. This program allows you to settle your tax debt for a smaller amount than owed, if you qualify.

The deadlines for the Offer in Compromise (OIC) program have extended as well. Taxpayers with existing payment plans are not obligated to pay anything until July 15. However, the unpaid balance will continue to accrue interest.

The same deadline applies to those who have a pending OIC application or are looking to file an OIC for a previous tax return. It is recommended that you file all of the necessary paperwork before July 15.

Child Support

Those who are behind on their child support will have the respective amount withheld from their stimulus check, as opposed to their tax return. The IRS will only take out what’s owed in child support; the rest of the stimulus money will be delivered directly to you.

Need a helping hand dealing with back taxes, especially during these trying times? Contact McClure & Stewart for affordable tax resolution services in Salt Lake City and the surrounding areas.