You’re tackling your issues with the IRS head-on, and you’ve made a very important first step: deciding to hire a tax resolution attorney to help protect your rights and negotiate a favorite resolution to your tax debt case.

What now? Should you just type “tax resolution services” into an internet search engine, click on the first link you see and hope for the best?

Of course not! You must do some homework, maybe even some legwork, before hiring a tax resolution attorney. Here are some key things to consider as you start the process.

Experience

Obviously, you don’t want just any fledgling lawyer serving as your guide and protector in a battle with a powerful government agency. You don’t want a jack-of-all-trades attorney with some knowledge of tax law. You want a tax resolution specialist who has handled these types of cases before, negotiated directly with the IRS on behalf of clients, and even presented arguments in tax court. Look for a tax lawyer with five full years in the business, at a minimum, and research their background before making a final decision.

Reputation

If you were hiring a home improvement contractor, a landscaping company, or even a new hair stylist, you would check online reviews or ask other customers their opinion on the service. Why wouldn’t you do similar due diligence about a tax attorney? Ask the firm you’re considering for a list of references and reach out to those current/former clients to find out everything you can about their experience.

Fees

The price of representation should not be a sensitive subject; it’s extremely important, especially when you’re dealing with significant tax debts. Choose a tax resolution attorney who communicates clearly what your financial responsibility will be, from the lawyer’s hourly rate to any incidental expenses that pop up throughout the course of the case. Be wary of anyone who claims to charge a flat rate or makes promises that seem too good to be true.

Personality

In the end, everything comes down to relationships and how people relate to and treat each other. You’re going to put your faith and trust in your tax attorney, and when you meet them face to face, if it doesn’t feel like a good fit, it’s probably not. While you’re probably eager to get your case resolved, jumping into a lawyer-client relationship with bad chemistry will only hurt you in the end.

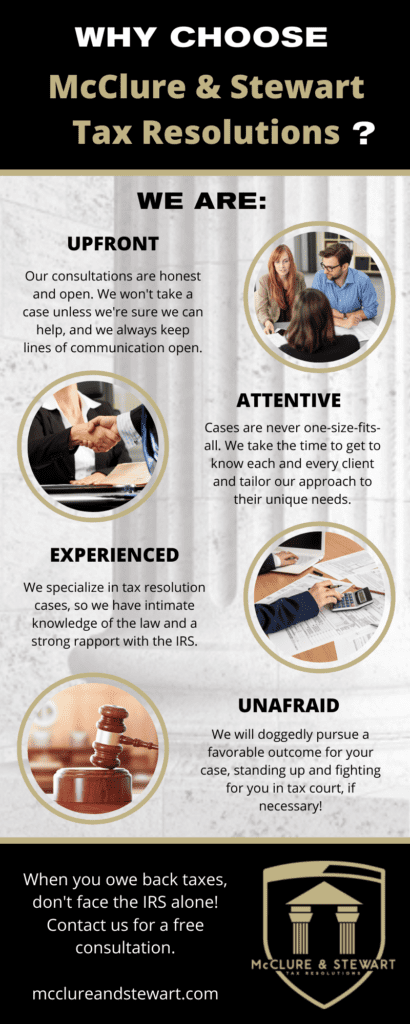

McClure & Stewart Tax Resolutions checks all the above boxes, as the following infographic illustrates.

Our tax resolution attorneys in Salt Lake City are highly qualified and dedicated to helping relieve our clients’ stress at a difficult time. Our top priority is making your tax problems a thing of the past! But you don’t have to take our word for it. Call us today, set up an in-person consultation, and find out for yourself!