You’re having a nice day. Things seem to be going your way. Then, you open your mailbox and find a letter from the Internal Revenue Service.

It’s not junk mail. You can’t just toss it in a pile and forget about it. No, the letter says you owe back taxes and will face stiff penalties if you don’t pay.

It’s a jarring experience — being confronted with this unpleasant scenario. What do you do? What if you don’t have the money? How are you going to get the IRS off your back?

At McClure & Stewart Tax Resolutions, we answer these questions for people like you every day. By providing tax resolution services in Salt Lake City and the surrounding areas, we clear up the confusion and ease the stress associated with tax problems.

If you find yourself owing back taxes, the journey to a resolution starts here. Read through this post, and don’t hesitate to contact our firm for help!

Don’t Take This Lightly

While there’s no need to go into panic mode, it’s important to give any notice from the IRS its due attention. They take these matters seriously, and not only do they possess the power to make your life difficult, but they’re also not afraid to wield it.

All that means is — don’t procrastinate. Make this issue a priority. Read the documents you’ve been sent, be mindful of any deadlines specified therein, and do not be afraid to call the IRS directly if you have questions or need clarification.

Consider the Amount

How much do you owe, and are you able to pay it off immediately, or would doing so create financial hardship for your family? How much time do you have before you’re expected to pay, and can you get the money together by that date?

Make an effort to work out a reasonable payment plan with the IRS. Do not drain your entire bank account or pull out a high-interest credit card and take on more debt to settle this debt.

Know Your Rights

As a taxpayer, you have the right to representation when dealing with the IRS. You have the right to due process in resolving the issue. You have the right to be treated with courtesy and professionalism.

You also have the right to pay only what you owe. If the IRS is contacting you about back taxes because you signed a tax return along with a former spouse or business associate, you might not be responsible for the debt. Contact a tax professional to find out if you qualify for “innocent spouse relief.”

Keep Detailed Records

Be sure to track all correspondence with the IRS, including phone conversations, and keep all documents and notes organized in a file. Ask for any offers the IRS makes you in writing.

Hire a Tax Resolution Attorney

Trying to resolve your tax issues on your own means taking on a large government bureaucracy with only one priority: collecting your money. Sound overwhelming? Fortunately, you don’t have to go up against the IRS alone.

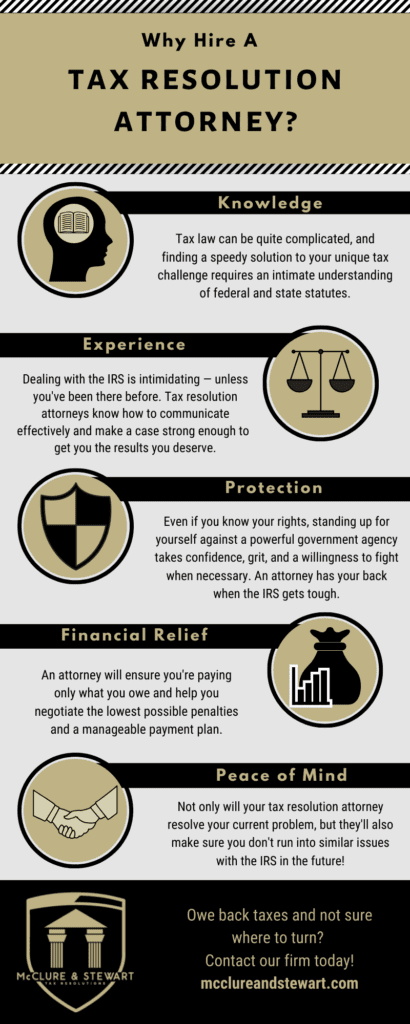

A tax resolution attorney can be an invaluable guide, advocate, and protector for clients facing a big tax bill. Check out this infographic for more details.

When you call McClure & Stewart Tax Resolutions to handle your tax problems in Salt Lake City and the surrounding communities, we’ll work closely with you and the IRS to resolve your case before any further financial damage is done. We’ll conduct a full tax analysis, assess your current tax status, build a strong case, and take it to court, if necessary.

Don’t waste time and energy worrying about your IRS issues. Contact our team today, and let’s get started finding a solution!