In helping clients in and around Salt Lake City resolve problems with back taxes and restore their good standing with the IRS, there’s one particular hurdle we often have to clear: unified tax returns.

As you know, most U.S. citizens are required to file an income tax return every year by April 15, although the Internal Revenue Service extended that long-standing deadline to July 15 this year, due to the coronavirus outbreak. Filing a return isn’t always a pleasing prospect, particularly if you expect to owe the government money. However, it’s not optional, and failing to do so is asking for trouble.

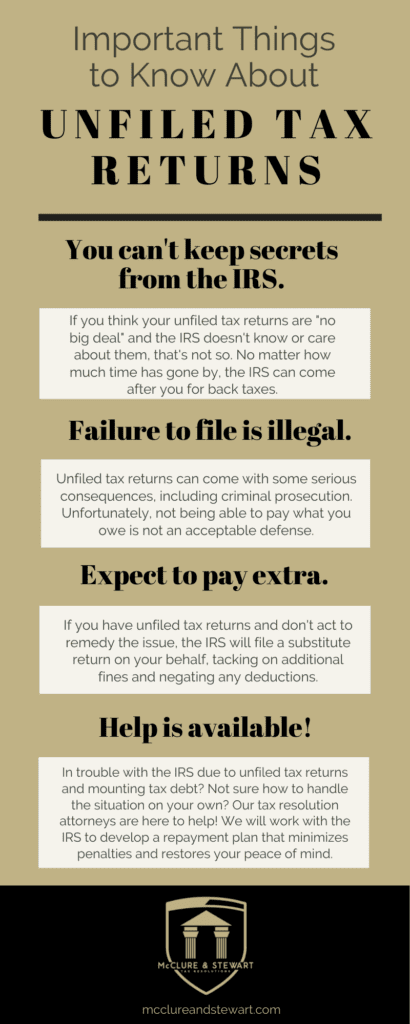

However, it’s not the end of the world. There are steps you can take to get back into the IRS’ good graces. Before we offer some tips on the best course of action, check out this infographic for some fast facts about unfiled tax returns:

As you can see, shrugging off or forgetting about an unfiled tax return will not make the problem go away magically. It will only make matters worse. After three years, the IRS has the right to claim any tax refunds you might have been due, and any back taxes you owed will be compounded by penalties with every passing month. You could even face jail time if you continue to let the problem fester.

That’s where we come in. Our tax resolution attorneys in Salt Lake City recommend the following steps for dealing with unfiled tax returns:

- Round up all of the necessary information you need to file your past-due return or returns.

- File those returns, keeping in mind that the IRS will assess all late returns with additional scrutiny, and audits are a very real possibility.

- Request a repayment arrangement or penalty relief, when applicable.

- Follow up with the IRS to make sure you are in compliance, and your case has been resolved.

Sounds easy, right? Of course, when you owe back taxes that you are unable to pay and are facing collections, liens or levies, and you’re not sure how to negotiate with the IRS, the situation can feel extremely complicated and overwhelming. Professional help is crucial for working out a favorable solution in a reasonable amount of time.

Our experienced tax attorneys can guide you through the process. We stay by your side, every step of the way, from a thorough tax analysis investigation that gets to the bottom of your tax history, to helping you complete your unfiled returns with painstaking attention to detail, to communicating with the IRS on your behalf to negotiate a debt resolution.

If unfiled tax returns have you in hot water with the IRS or you’re experiencing any other tax debt problems, please contact us today to schedule a free consultation.