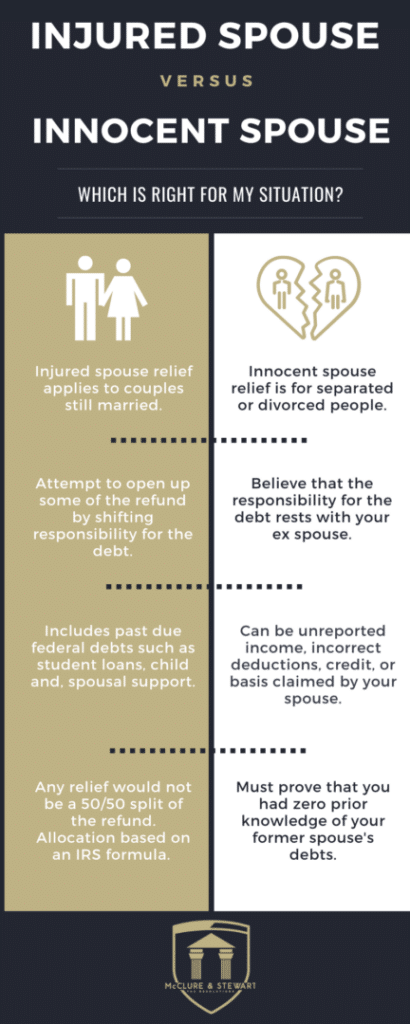

Tax season presents challenges for people every year. When you file a joint tax return for the first time with your spouse, the IRS treats the joint return a little differently than when you filed a single tax return in the past. Tax law holds both you and your spouse responsible for any debts either of you have incurred. The IRS can collect on that debt from both of you or one of you, depending on the circumstances. This remains true even if you go through divorce proceedings and are no longer legally together. There are ways that you can file for an innocent spouse or injured spouse relief with our Salt Lake County-based tax resolution attorneys at McClure & Stewart Tax Resolutions. But what’s the difference between the two options and which is right for your situation?

Innocent Spouse Relief

You may file for innocent spouse relief when you become aware of the tax liability from your joint filing and believe that the responsibility is not yours. The liability falls with your spouse or ex-spouse entirely. Typically, innocent spouse relief is granted to those who are no longer married, since they are no longer under the same roof and can more easily prove that they are unaware of the debts that their ex incurred.

Injured Spouse Relief

For still married couples looking to shift the tax liability burden, they want to file for injured spouse relief. You may file for the injured spouse relief when your share of the tax refund has or will be applied to your spouse’s past-due federal debts, such as student loans, state taxes, and child or spousal support. Usually, their tax ID number will trigger these flags and will offset the entire refund to cover the debts. If you are indeed entitled to injured spouse relief, you may get your portion of the return released to you.

However, that share is not a 50/50 split of the total refund. A formula determines your share. Each spouse must file their wages, self-employment income, and any applicable credits across separate forms, while items that are commingled will be split evenly. The IRS calculates the allocation and determines how much of the refund, if any, goes to the injured spouse.

Joint tax returns can prove to be a complicated minefield to navigate. There are potentially many past debts that you are unaware of that can cause undue hardship. Knowing your options for salvaging at least some of your tax refund will help put your mind at ease during these difficult times.

If you are in the Salt Lake City area and require a consultation with a tax attorney or would like to learn more, contact McClure & Stewart Tax Resolutions today!